InflatableOffice currently has an implementation to help you with the Admission and Amusement Tax if you are servicing Maryland events. To use it, you would first turn Amusement Tax on in Tax Settings. Here is how it then works.

- We use the city, county, and sometimes zip code for leads with a Maryland venue address to find the tax rate and subdivision.

- We add an AA Tax fee with the subdivision to the lead for the tax total. This is not something the user can manipulate. It is also recalculated every time the lead is saved based on the current state of the lead.

- The tax is calculated per Maryland's requirement regarding sales tax and amusement tax.

- You can set whether a rental or fee/promo is subject to AA Tax.

- All quick add items and custom fees/promos are set to be subject to AA Tax by default.

- We sum all positive and negative (effectively subtracting the negative values from the positive) values that are subject to AA Tax and multiply by the appropriate AA Tax rate, taking into account the possible different rate based on whether the item is subject to sales tax or not.

- Credit card surcharge fees are excluded.

It should be noted that we do not monitor changes to the AA Tax. If there are rate, subdivision, or other changes, it is the responsibility of the user to communicate with us so we can determine if we can make the changes.

If an event end time is in the past and the status is complete, we don't do anything with AA Tax. The reason being is that you likely do not want this value changing after the event is over and you've reported your AA Tax regardless of the changes you are making to the lead or if the calculation has changed due to changes in tax rates. However, if you need to recalculate the AA Tax for a past lead, you can force the system to recalculate it by deleting the AA Tax from the lead and saving the lead.

Because AA Tax calculations are difficult and not always obvious, we have added a help icon next to the AA Tax line on the lead that you can click to open an additional page that will show you the detailed calculation. This is only available to leads created after 7/18/2023.

Reporting

When it comes time to reporting, you can build a report as shown below and apply it to a filtered set of leads. Most likely you would want to filter the date range and status of the lead at least.

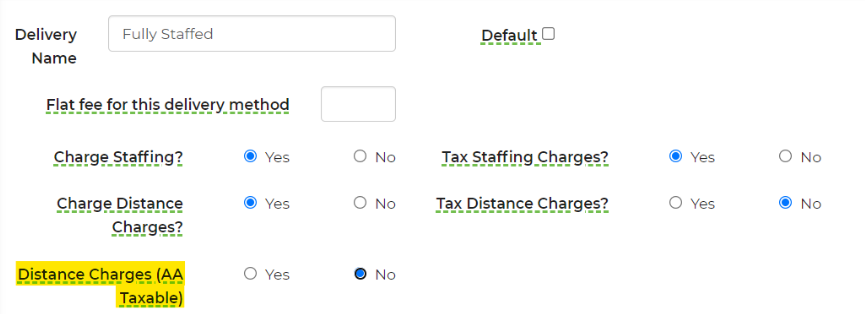

Staffed Event

In some cases, a staffed event may not be taxable. To turn these taxes off, you must go into your Settings -> Delivery Methods -> select the option applicable to staffed events and turn off Distance Charges (AA Taxable). This is specific to each delivery method.

Promotions &Fees

You can create your own promotions and fees by going to Settings-->Promotions & Fees. If the fee is not taxable, go to the extra details section and uncheck "AA Taxable"

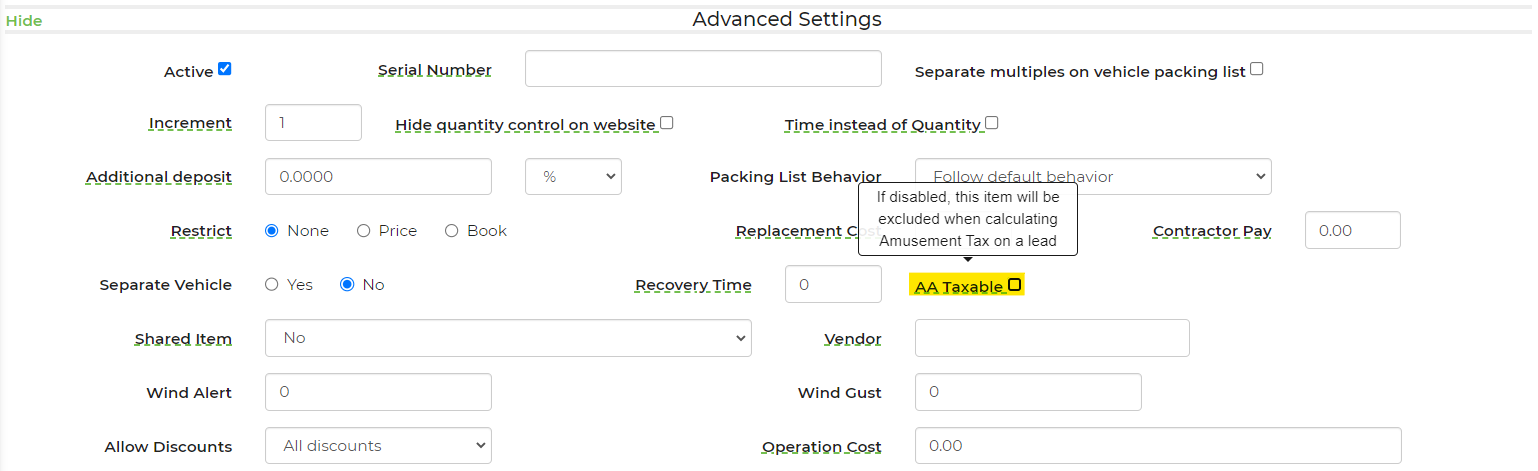

Inventory

If there is certain inventory that does not get taxed (such as concessions), you can toggle off the tax settings per item. This is found in the Advanced Settings of each piece of inventory, as highlighted below.

Conditional Pricing on Specific Delivery Methods

In a situation where you are not taxing the items but are taxing a specific delivery method, you would then have to create a filter and apply conditional pricing for this. Here is an example of what conditional pricing would look like per delivery method, not on the inventory itself.

Here is a video for detailed information: