sales taxes should apply to negative amount

Awaiting Reply

Hello

Please see leads

#12845333

The sales tax should apply on a negative amount but does not

Where do i program this ?

Please see leads

The sales tax should apply on a negative amount but does not

Where do i program this ?

Use the checkboxes beside each line item to apply/remove taxes from each item on the lead. When they are not are not saved discounts or fees this has to be done manually...otherwise can be done under Promotions & Fees

Use the checkboxes beside each line item to apply/remove taxes from each item on the lead. When they are not are not saved discounts or fees this has to be done manually...otherwise can be done under Promotions & Fees

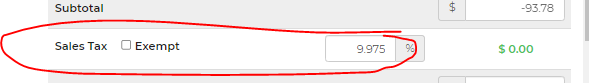

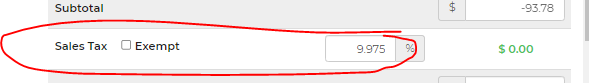

Each checkboxes are selected but still no calculation of the 9.975%

When i click on the green $0,00, it says

Taxab;e subtotal; $0

Non-taxable subtotal: $-93,78

Each checkboxes are selected but still no calculation of the 9.975%

When i click on the green $0,00, it says

Taxab;e subtotal; $0

Non-taxable subtotal: $-93,78

See screenshot

See screenshot

Calculation of sales tax should be 9,975% of -89,31 = -8,91

Calculation of sales tax should be 9,975% of -89,31 = -8,91

I only unchecked one box...did you uncheck them all?

I only unchecked one box...did you uncheck them all?

No... i calculated it manally to see:

Items + shipping - discount = -89,31

TPS is 5% of -89.31 = -4,47

sales taxe should be 9,975% of -89,31 (not calculated on the TPS) = -8,91$

For a total of -102,69 for which we will issue a gift card

No... i calculated it manally to see:

Items + shipping - discount = -89,31

TPS is 5% of -89.31 = -4,47

sales taxe should be 9,975% of -89,31 (not calculated on the TPS) = -8,91$

For a total of -102,69 for which we will issue a gift card

I keep trying and it keeps coming up w/ the 93.78 credit.

I keep trying and it keeps coming up w/ the 93.78 credit.

it is as if the sales tax from ''tax preferences'' does not apply to negative amount but i think it should

it is as if the sales tax from ''tax preferences'' does not apply to negative amount but i think it should

But you can adjust where you want the taxes to apply...each line of the lead w/ the check boxes. So go through and check or uncheck the balances you want the taxes applied to

But you can adjust where you want the taxes to apply...each line of the lead w/ the check boxes. So go through and check or uncheck the balances you want the taxes applied to

I know but even if the box of the discount is checked, it does not calculate when the total is negative

I went to see an other exemple.

The total in the red box is 696.25 and both the 5% and the 9,975% is calculated correctly #12841585

but in the other lead i gave you, same boxes checked but the total in the red box is negative and then the 9,975% is not calculated

I know but even if the box of the discount is checked, it does not calculate when the total is negative

I went to see an other exemple.

The total in the red box is 696.25 and both the 5% and the 9,975% is calculated correctly #12841585

but in the other lead i gave you, same boxes checked but the total in the red box is negative and then the 9,975% is not calculated

If you check and uncheck you can clearly see there's a difference in the calculation

If you check and uncheck you can clearly see there's a difference in the calculation

I know BUT even if i check the box of the credit that is negative, the sales tax does not calculate

In the exemple below, tax should be -135.34$

I know BUT even if i check the box of the credit that is negative, the sales tax does not calculate

In the exemple below, tax should be -135.34$

Hello, Just want to make sure you received my last information. If this can't be fix, we will treat this differently

Thank you

Hello, Just want to make sure you received my last information. If this can't be fix, we will treat this differently

Thank you

Replies have been locked on this page!